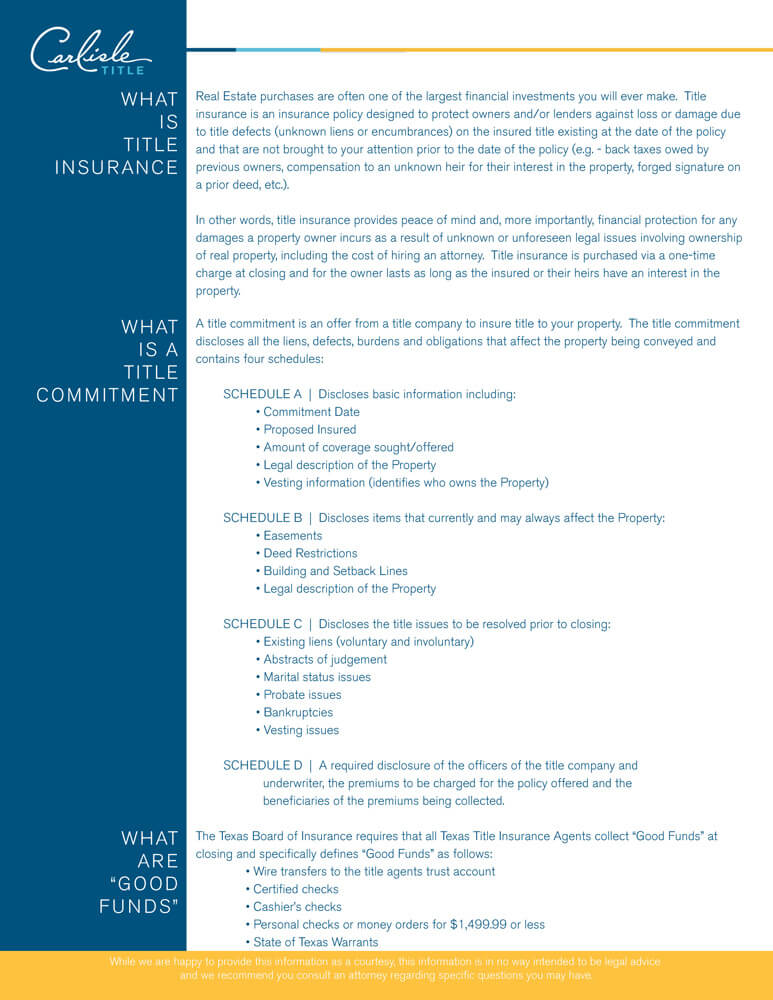

What is Title Insurance?

Real Estate purchases are often one of the largest financial investments you will ever make. Title insurance is an insurance policy designed to protect owners and/or lenders against loss or damage due to title defects (unknown liens or encumbrances) on the insured title existing at the date of the policy and that are not brought to your attention prior to the date of the policy (e.g. – back taxes owed by previous owners, compensation to an unknown heir for their interest in the property, forged signature on a prior deed, etc.).

In other words, title insurance provides peace of mind and, more importantly, financial protection for any damages a property owner incurs as a result of unknown or unforeseen legal issues involving ownership of real property, including the cost of hiring an attorney. Title insurance is purchased via a one-time charge at closing and for the owner lasts as long as the insured or their heirs have an interest in the property.

What is a Title Commitment?

A title commitment is an offer from a title company to insure title to your property. The title commitment discloses all the liens, defects, burdens and obligations that affect the property being conveyed and contains four schedules:

SCHEDULE A | Discloses basic information including:

- Commitment Date

- Proposed Insured

- Amount of coverage sought/offered

- Legal description of the Property

- Vesting information (identifies who owns the Property)

SCHEDULE B | Discloses items that currently and may always affect the Property:

- Easements

- Deed Restrictions

- Building and Setback Lines

- Legal description of the Property

SCHEDULE C | Discloses the title issues to be resolved prior to closing:

- Existing liens (voluntary and involuntary)

- Abstracts of judgement

- Marital status issues

- Probate issues

- Bankruptcies

- Vesting issues

SCHEDULE D | A required disclosure of the officers of the title company and underwriter, the premiums to be charged for the policy offered and the beneficiaries of the premiums being collected.

What are “Good Funds”?

The Texas Board of Insurance requires that all Texas Title Insurance Agents collect “Good Funds” at closing and specifically defines “Good Funds” as follows:

- Wire transfers to the title agents trust account

- Certified checks

- Cashier’s checks

- Personal checks or money orders for $1,499.99 or less

- State of Texas Warrants

While we are happy to provide this information as a courtesy, this information is in no way intended to be legal advice and we recommend you consult an attorney regarding specific questions you may have.