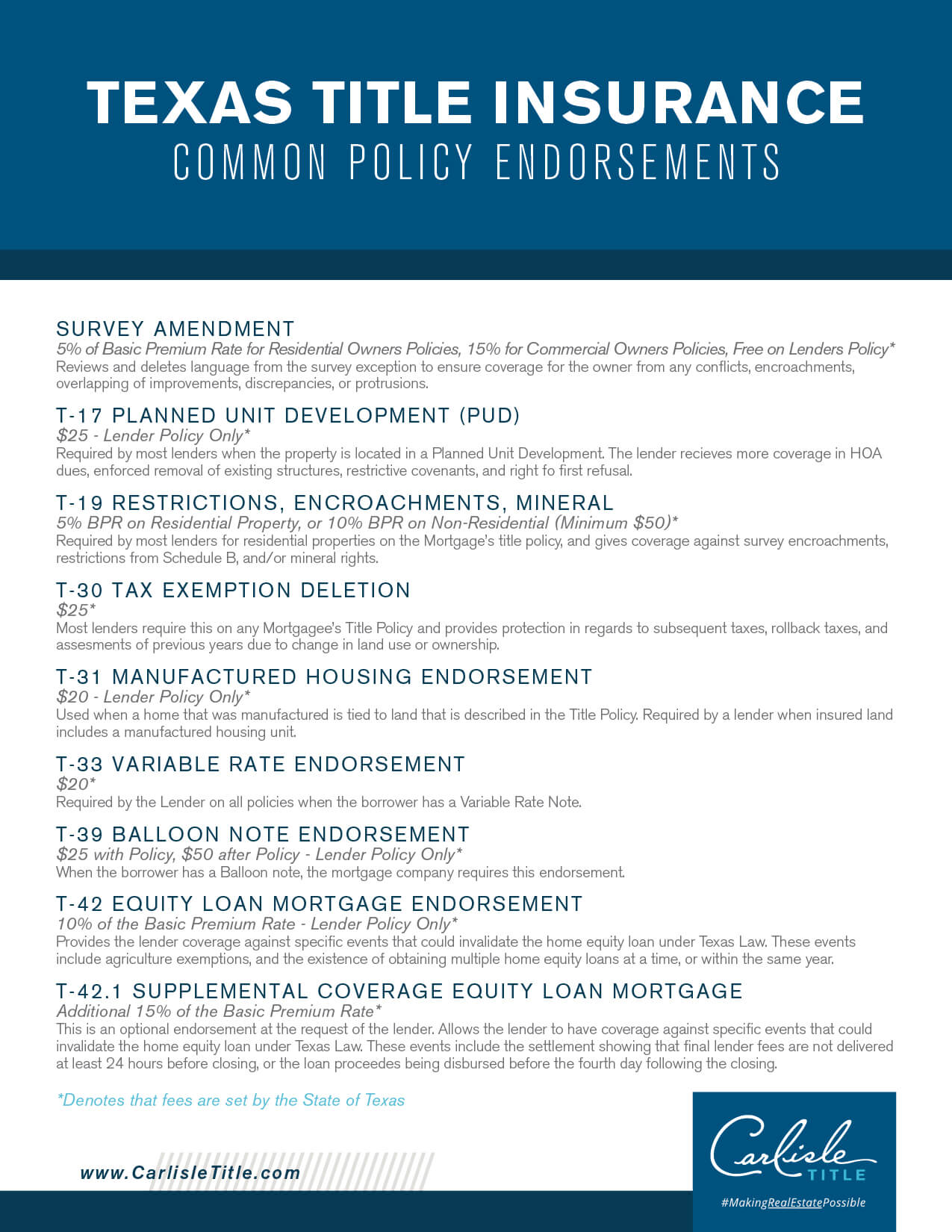

SURVEY AMENDMENT

5% of Basic Premium Rate for Residential Owners Policies (ROP), 15% for Owners Policies (Commercial), Free on Lenders Policy*

Reviews and deletes language from the survey exception to ensure coverage for the owner from any conflicts, encroachments, overlapping of improvements, discrepancies, or protrusions.

T-17 PLANNED UNIT DEVELOPMENT (PUD)

$25 – Lender Policy Only*

Required by most lenders when the property is located in a Planned Unit Development. The lender recieves more coverage in HOA dues, enforced removal of existing structures, restrictive covenants, and right fo first refusal.

T-19 RESTRICTIONS, ENCROACHMENTS, MINERAL

5% BPR on Residential Property, or 10% BPR on Non-Residential (Minimum $50)*

Required by most lenders for residential properties on the Mortgage’s title policy, and gives coverage against survey encroachments, restrictions from Schedule B, and/or mineral rights

T-30 TAX EXEMPTION DELETION

$25*

Most lenders require this on any Mortgagee’s Title Policy and provides protection in regards to subsequent taxes, rollback taxes, and assesments of previous years due to change in land use or ownership.

T-31 MANUFACTURED HOUSING ENDORSEMENT

$20 – Lender Policy Only*

Used when a home that was manufactured is tied to land that is described in the Title Policy.

Required by a lender when insured land includes a manufactured housing unit.

T-33 VARIABLE RATE ENDORSEMENT

$20*

Required by the Lender on all policies when the borrower has a Variable Rate Note.

T-39 BALLOON NOTE ENDORSEMENT

$25 with Policy, $50 after Policy – Lender Policy Only*

When the borrower has a Balloon note, the mortgage company requires this endorsement.

T-42 EQUITY LOAN MORTGAGE ENDORSEMENT

10% of the Basic Premium Rate – Lender Policy Only*

Provides the lender coverage against specific events that could invalidate the home equity loan under Texas Law. These events include agriculture exemptions, and the existence of obtaining multiple home equity loans at a time, or within the same year

T-42.1 SUPPLEMENTAL COVERAGE EQUITY LOAN MORTGAGE

Additional 15% of the Basic Premium Rate*

This is an optional endorsement at the request of the lender. Allows the lender to have coverage against specific events that could invalidate the home equity loan under Texas Law. These events include the settlement showing that final lender fees are not delivered at least 24 hours before closing, or the loan proceedes being disbursed before the fourth day following the closing.

*Denotes that fees are set by the State of Texas